As already seen in calculating gross profit in 4.1, it is necessary to calculate the cost price of an item before the gross profit can be calculated.

- Net purchase price

The Net purchase price consists of the supplier’s price less discount received (net invoice price), and any adjustments with regard to possible purchase returns form part of the cost price of an item. |

- Supplementary cost

This consists of costs such as courier, railage or transport costs from the supplier to the business’s premises. As well as clearance costs and import duties or similar costs that form part of the cost price of an item.

- Cost price per item

The unit cost price is calculated by adding the net purchase price to the supplementary cost.

The cost price is also known as the landed cost of a product, which includes the net purchase price plus any adjustments such as supplementary cost, which are directly related to the cost price. |

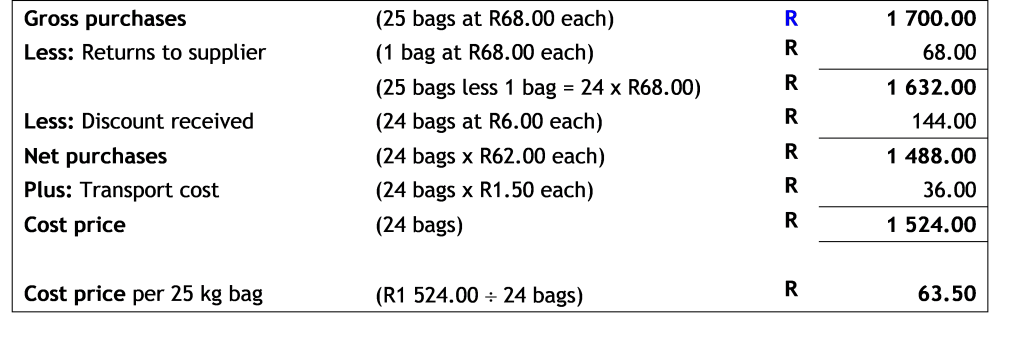

Example: Cost price | |

A general dealer buys and sells mealie meal. The business buys a 25 kg bag of mealie meal for R68.00 and receives a discount of R6.00 per bag. The selling price of a 25 kg bag of mealie meal is R77.50.

The dealer bought 25 bags of mealie meal and returned 1 damaged bag to the supplier, sold 23 bags of which 3 bags were returned by a customer who received a cash refund. The dealer also paid a transport company R1.50 per bag transportation cost for transporting the mealie meal from the supplier to his business.

Calculate the cost price of a 25 kg bag of mealie meal.

Calculations

| |